Key Factors That Influence Home Affordability

Determining how much home you can afford involves evaluating several financial factors, including your income, expenses, credit score, and the type of mortgage you choose. Here’s a comprehensive guide to help you assess your affordability:

Home Purchase

Refinance

How Much Home can I get

Loan Options

Determine Your Down Payment

The more you can put down, the lower your mortgage amount will be. Traditional loans often require 20%, but many options are available with lower down payments (FHA loans may require as little as 3.5%).

Estimate Mortgage Rates

Research current mortgage rates. These can fluctuate based on the market, your credit score, and the type of mortgage. A lower interest rate can significantly affect your monthly payments.

Types of Mortgage Insurance

1. Calculate Your Income

Gross Monthly Income: Start with your gross income (before taxes and deductions). Include all sources, such as salary, bonuses, and any other income.

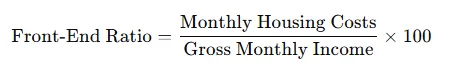

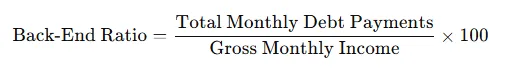

2. Assess Your Debt-to-Income Ratio (DTI)

Front-End Ratio: This measures how much of your income goes towards housing costs (including mortgage payments, property taxes, and insurance). Lenders typically prefer a ratio of 28% or lower.

Back-End Ratio: This measures your total monthly debt payments (including housing, car loans, student loans, credit cards, etc.). A common threshold is 36% or lower.

Use a Mortgage Calculator

Utilizing a mortgage calculator can simplify your calculations. You’ll typically input the following:

Home price

Down payment amount

Interest rate

Property taxes

Homeowner’s insurance

PMI (if applicable)

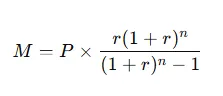

Calculate Monthly Payments

Here’s a simplified formula to estimate your monthly mortgage payment (excluding taxes and insurance):

M = total monthly mortgage payment

P = the loan amount (home price - down payment)

r = monthly interest rate (annual rate / 12)

n = number of payments (loan term in months)

Consider Additional Costs

Property Taxes: Typically 1-2% of the home’s value annually, depending on the location.

Homeowners Insurance: Can vary widely but budget around $500-$1,500 per year.

Maintenance and Repairs: A general rule of thumb is to budget about 1% of the home’s value annually for maintenance.

HOA Fees: If applicable, consider any homeowners association fees.

Assess Your Financial Situation

Emergency Fund: Ensure you have savings for unexpected expenses

Long-Term Goals: Consider your other financial goals (saving for retirement, education, etc.) before committing to a mortgage.

Example Calculation

Assumptions:

Gross monthly income: $5,000Monthly debts (car payment, student loans): $500Desired monthly mortgage payment: $1,200Down payment: 20% on a home price of $300,000

Calculate DTI Ratios:

Monthly housing cost = $1,200Total monthly debt = $1,700 ($1,200 + $500)

Front-End Ratio:

12005000×100=24%\frac{1200}{5000} \times 100 = 24\%50001200×100=24%

Back-End Ratio:

17005000×100=34%\frac{1700}{5000} \times 100 = 34\%50001700×100=34%

Both ratios are within acceptable limits (28% for front-end and 36% for back-end).

Conclusion

Using these calculations, you can get a clearer picture of what you can afford. It’s always a good idea to consult with a mortgage lender for pre-approval, which will give you a more accurate assessment based on current rates and your financial situation.

Who We Are:

Check out what our clients had to say!

Kirk was knowledgeable, fast to respond, and genuinely cared about the thing he was telling us about. We couldn’t have done this better without him.

JENNIFER N.

Saved veteran over $16k. The national veteran company that advertises a lot was charging him $20k in fees. I was able to do the same loan with a credit score under 580 and our fees were only $3400.

EMILY G.